Mourning but learning from Urban Ladder

Why read this story?

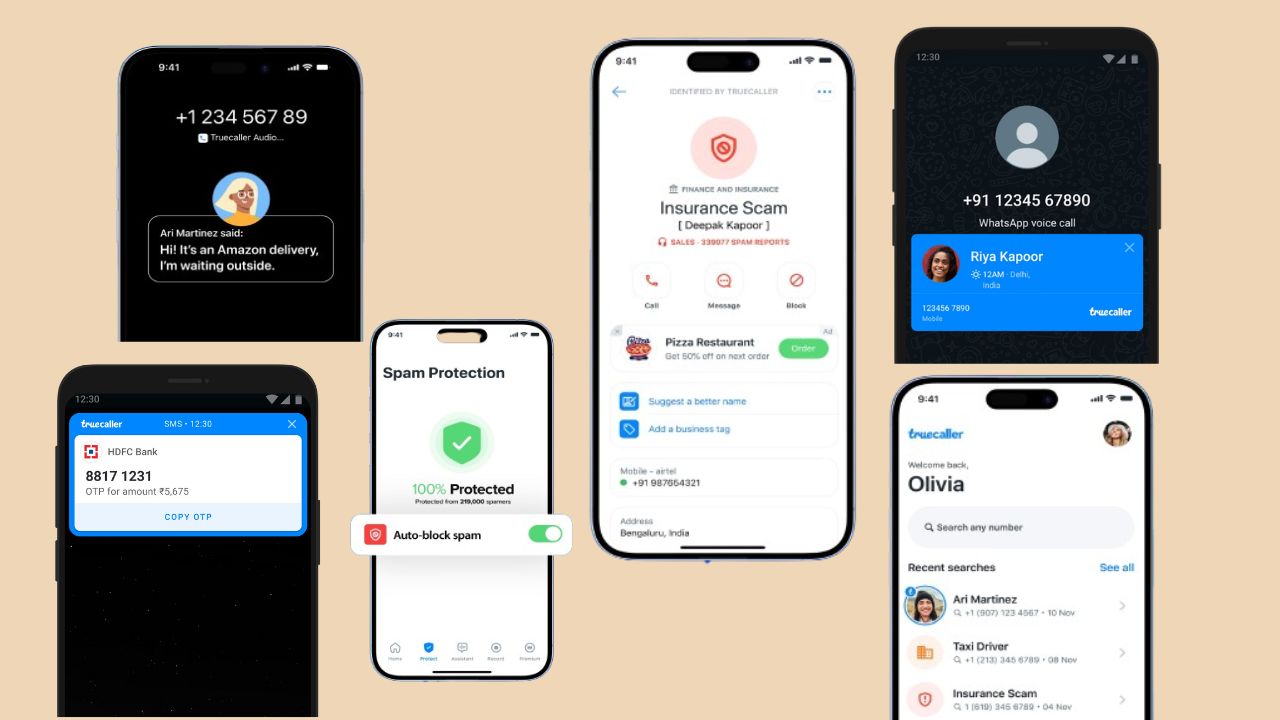

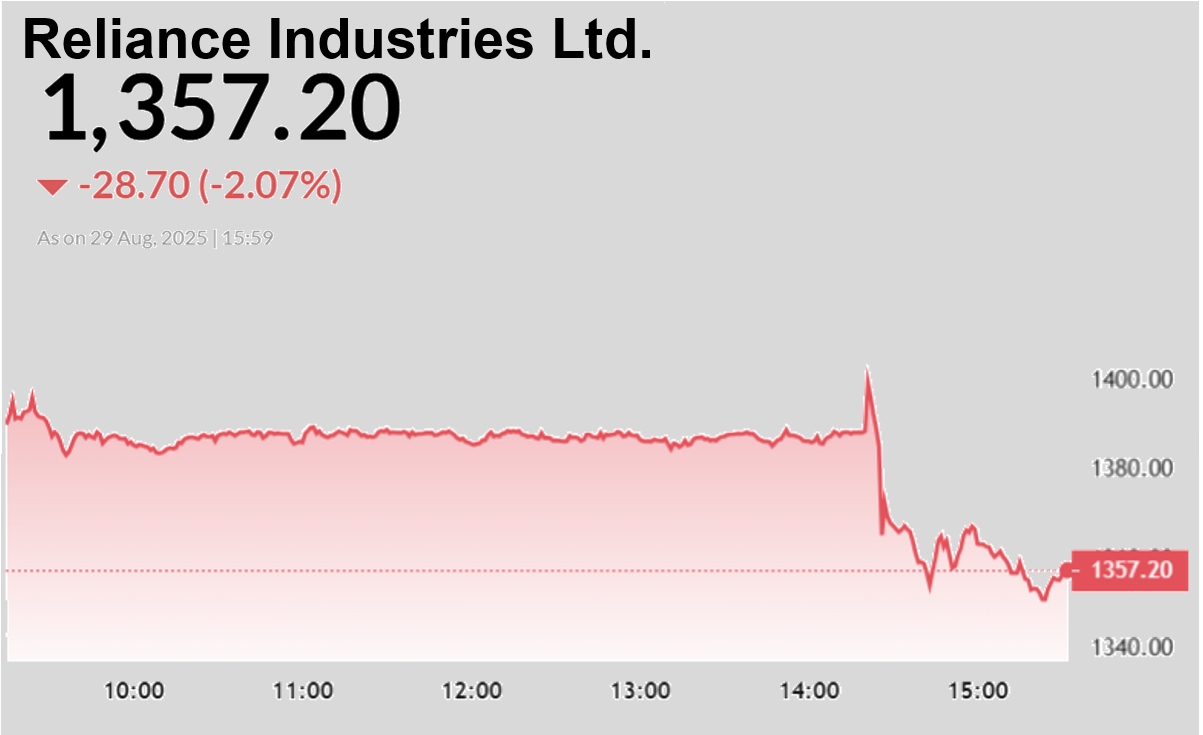

Editor's note: In our little urban bubble that is people who shop online, Urban Ladder’s sale to Reliance Retail Ventures last week set off a sort of glum chain reaction. Many expressed surprise that the company went out with a whimper and not a bang, which was contrary to their own experience of buying furniture from the company. Where customers absolutely loved the product and the experience, and so imagined that Urban Ladder must be prospering, when in fact it was anything but. Reliance Industries Ltd (RIL) has acquired online furniture seller Urban Ladder Home Decor Solutions Pvt. Ltd for ₹182.12 crore, expanding its presence in India’s fast-growing e-commerce market. Reliance Retail Ventures Ltd (RRVL), the retail unit of billionaire Mukesh Ambani’s RIL, bought 96% of Urban Ladder and has the option to buy the remaining 4% stake, the company said in a stock exchange filing on Saturday night. RRVL proposes to make a further investment of up to ₹75 crore, taking its ownership to 100% in the furniture e-tailer, which is expected to be completed by December 2023. Eight-year-old Urban Ladder …

More in Internet

You may also like

Conglomerates, duopolies and domination hamper India

The domination of a few business groups—conglomerates—is a defining feature of the country’s economy. This has been enabled by policy, leading to stifled innovation and hindered progress. All of this, in turn, exacerbates inequalities.

An uneventful Reliance AGM that could not have been otherwise

Everyone seems to be disappointed with the company’s annual general meeting. With hands full and businesses that need further nurturing, this was not the time for big-bang announcements. And so it was.

Mukesh Ambani faces big test in race to protect his cash engine

With Russian crude turning into a liability, RIL needs to rebalance its oil basket. Can its chairman pull this off without seriously impacting the lucrative oil-to-chemicals business and limiting future investment firepower?