At Byju’s, a loan crisis and no sign of funding

The edtech giant is stuck with a rising pile of unpaid loans of customers who have cancelled courses even as its founders scour the globe in search of a saviour.

20 March, 2023•12 min

0

20 March, 2023•12 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: “We were always told, teachers don’t cheat people. If teachers start defrauding, where will we go,” says P over the phone from Jammu. “I saved every penny and put all into my child’s education. And now I am stuck. My child isn’t going to classes. My money is gone. My credit rating has been destroyed.” P paid almost Rs 40,000 (down payment + first equated monthly instalment) in June 2022 to enrol his child in a batch at a Byju’s Tuition Centre. That is a month’s salary for him. He also took a Rs 2.3 lakh loan from education-focused financial company Avanse Financial Services. The Byju’s salesperson who processed the papers told P he could cancel anytime within a month and get a full refund. Classes didn’t start for a month. P was finally told that his child will get classes at an Aakash Educational Services tuition centre and not at Byju’s. Worse, his child was enrolled in a batch that was already three months old. The child felt lost. P called the salesperson, went to the tuition centre, even …

More in Internet

Internet

Inside the math of instant help startups

Millions of VC dollars are being splurged to service the last-minute needs of Indians—little revenue, increasing cash burn and far too many variables. At what point does it all come together?

You may also like

Internet

AI MBA Is Preparing Managers For A New Business Order

As AI advances rapidly, leadership, judgment and strategy matter more than ever. Today’s MBA is evolving to shape leaders for an AI-led world.

Internet

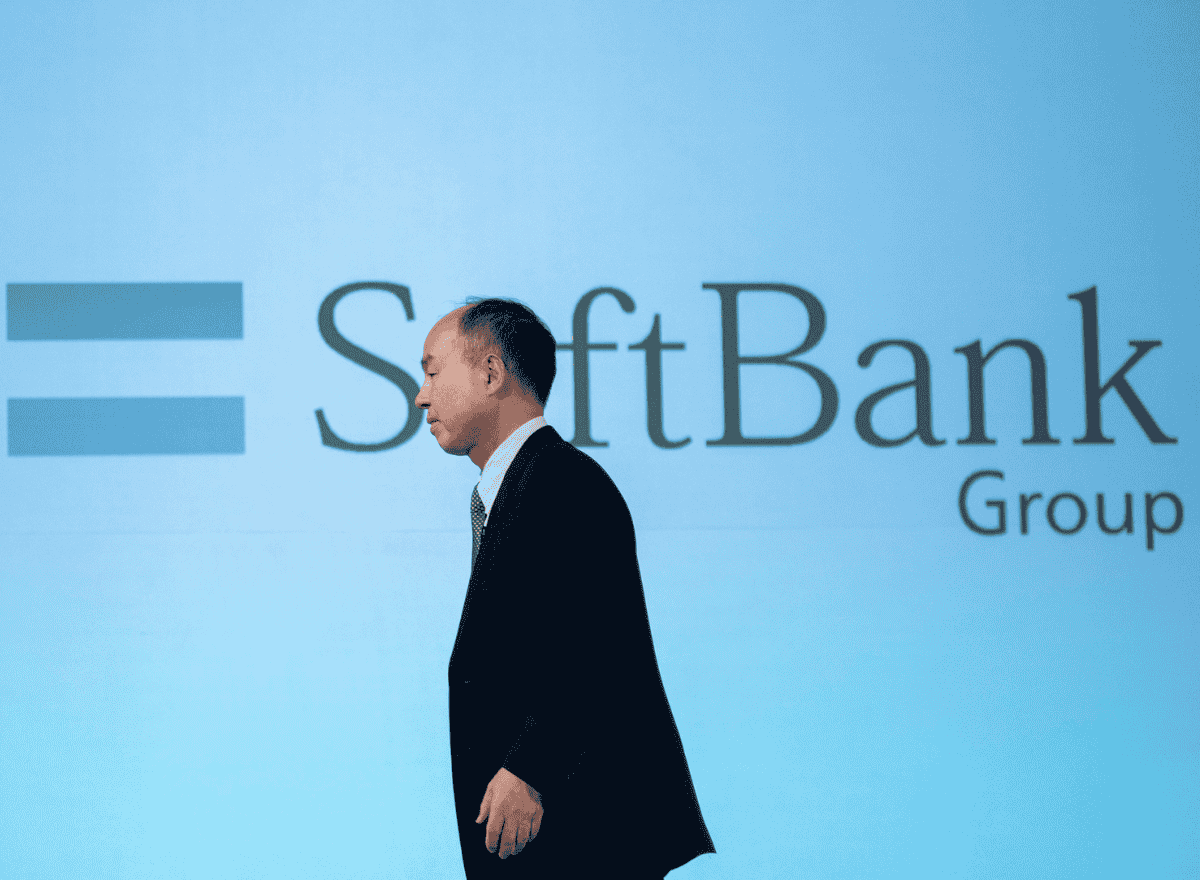

Why SoftBank has shunned India

For one of the world’s largest and shrewdest investors to entirely skip putting money in the country is a sign of how quickly the nature of the Indian startup ecosystem has changed.

Internet

Ronnie Screwvala is stretching upGrad to mean more

As the company weighs a move into test prep ahead of a 2027 IPO, the question is whether entering a category from which upGrad has consciously stayed away so far makes sense.