What is Groww’s endgame?

13 May, 2021•6 min

0

13 May, 2021•6 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: So, the new unicorn in town is shaking things up in the fintech space. Groww, the Bengaluru-based mutual fund platform, has decided to enter the big leagues with the announcement of acquiring an asset management company, or AMC in mutual fund parlance. It has entered into a definitive agreement with Indiabulls Housing Finance Ltd to acquire the mutual fund business of its subsidiaries Indiabulls Asset Management Co. Ltd and Indiabulls Trustee Co. Ltd, the trustee of the AMC, for Rs 175 crore (of which Rs 100 crore is in cash). Let us leave the technicalities and the value of the acquisition for some other day, but this development is interesting on several fronts. If this acquisition, which is subject to regulatory approval, goes through in another two to three months, Groww will probably be the first fintech company to enter the Rs 32 lakh crore asset management space. Rival Zerodha, and the market leader in stockbroking and online mutual fund sales, has also applied for its own AMC licence. Zerodha is yet to get the final approval and it might …

More in Internet

Internet

Bravado, IPO and OYO

A debt-heavy global pivot to modest motels and accounting-led profits define the company now heading to Indian public markets.

You may also like

Internet

As its core weakens, Groww looks elsewhere

Ropes in US-based State Street as an investor in its AMC business—part of a diversification drive into longer-term growth lines.

Internet

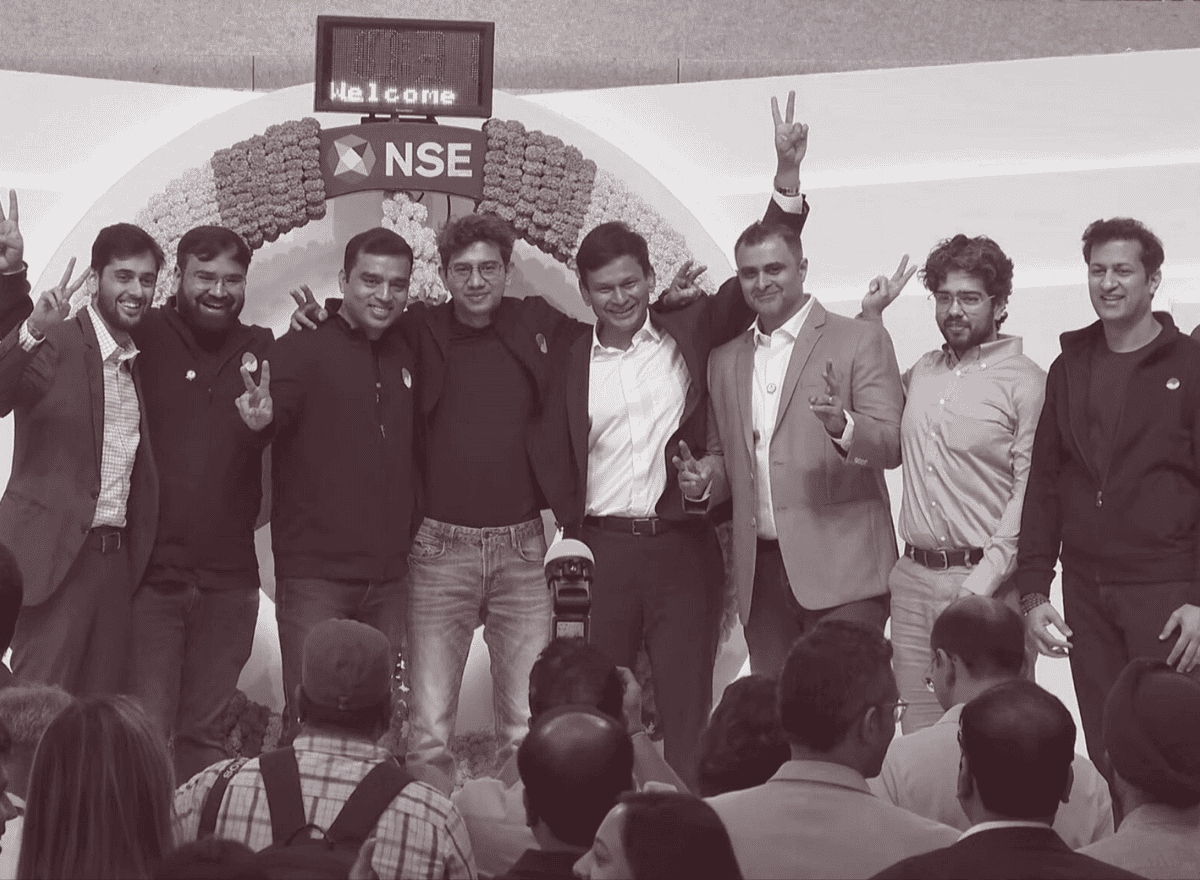

Groww strikes a conservative note

The first quarterly results since going public show the online stockbroker is on course to grow its new line of businesses. But investors need to be patient.

Internet

Peak XV’s ducks-in-a-row moment is here

After the anxiety of its split with Sequoia, a spell of founder run-ins, senior-level churn and tighter capital, things finally seem to be turning for Peak XV Partners.