Why investors would do well to avoid Corrtech and Joyalukkas IPOs

Claims notwithstanding, both companies operate in tough sectors and have their fair share of issues.

12 May, 2022•9 min

0

12 May, 2022•9 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: When established businesses decide to do an IPO, the most important change they want to showcase is that they are open to a public scrutiny of their performance. That is usually a far more important consideration than, say, wanting the public to be a part of their growth or using the listed tag for better comfort with lenders. This was perhaps the most important facet even in the recent public issue of shares of Life Insurance Corp. of India, whose financials were shrouded in mystery for over six decades. So, when I want to gauge a promoter’s purpose behind an IPO, I head to the page of the prospectus that lists the directors. My reckoning is that if a company has decided to open its books to regulators and the public, there should be some evidence that the company’s founders are willing to be asked questions by representatives of the public at large—the independent directors. Let’s for a moment forget that independent directors haven’t exactly covered themselves in glory over the years and asked the right questions. Just the presence …

More in Business

Business

SEBI’s overdue expansion is underway, but top-level gaps persist

India’s market regulator is looking to ramp up hiring at the entry level. But what really needs attention is the constant uncertainty at the top and the lack of domain experts.

You may also like

Business

Ten business developments for 2026

Who’s going to lead the IPO party, what’s going to drive the market, where are some of the leading businesses headed, and more.

Business

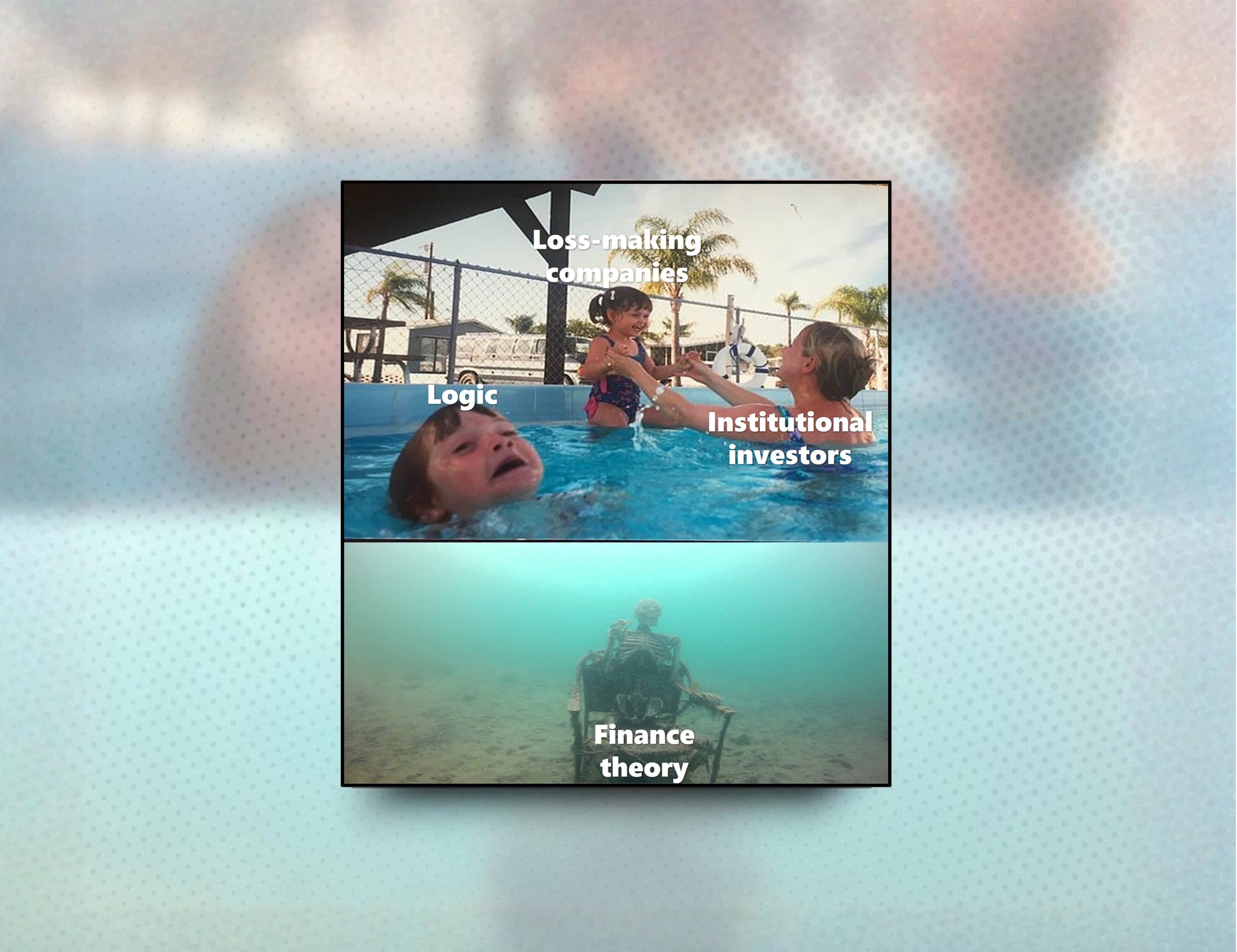

How India’s retail shareholders are being left holding the can

Swiggy and Ola Electric’s plans to return to the public markets soon after big-bang IPOs leave investors with dilution, little prospect of returns and plenty of questions.

Internet

In India’s Lenskart IPO, a success for ADIA

The sovereign wealth fund’s big bet on the Indian eyewear company, Microsoft’s AI win in the Emirates and other updates from the week.