Red flags in Axis Bank’s insurance play

The bank was pulled up last month over irregular transactions with Max Life, and there remain unasked and unanswered questions over its indirect stake in Niva Bupa.

16 November, 2022•9 min

0

16 November, 2022•9 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: On 14 October, the Insurance Regulatory and Development Authority of India fined Axis Bank Rs 2 crore. The move could dampen the ambitions that CEO Amitabh Chaudhry has for the private sector lender in the insurance sector. The fine was imposed on two counts: The bank was deemed to have violated norms around calculating the fair market value of Max Life Insurance in a series of share transactions between 2016 and 2021.Making excess gains from these share purchases beyond the permissible cap for a registered corporate agent. The insurance regulator also fined Max Life Rs 3 crore. The insurance regulator’s scrutiny was based on eight transactions between the bank and Max Life’s promoters: Max Financial Services and Mitsui Sumitomo Insurance. Axis Bank was sold shares of the life insurer at nominal rates and these shares were then sold back to the promoters at over 10x the price. In these deals, the bank pocketed a profit of Rs 898 crore. Given that Axis Bank sells insurance policies for Max Life as a bancassurance partner, IRDAI considered these transactions as commissions paid …

More in Business

Business

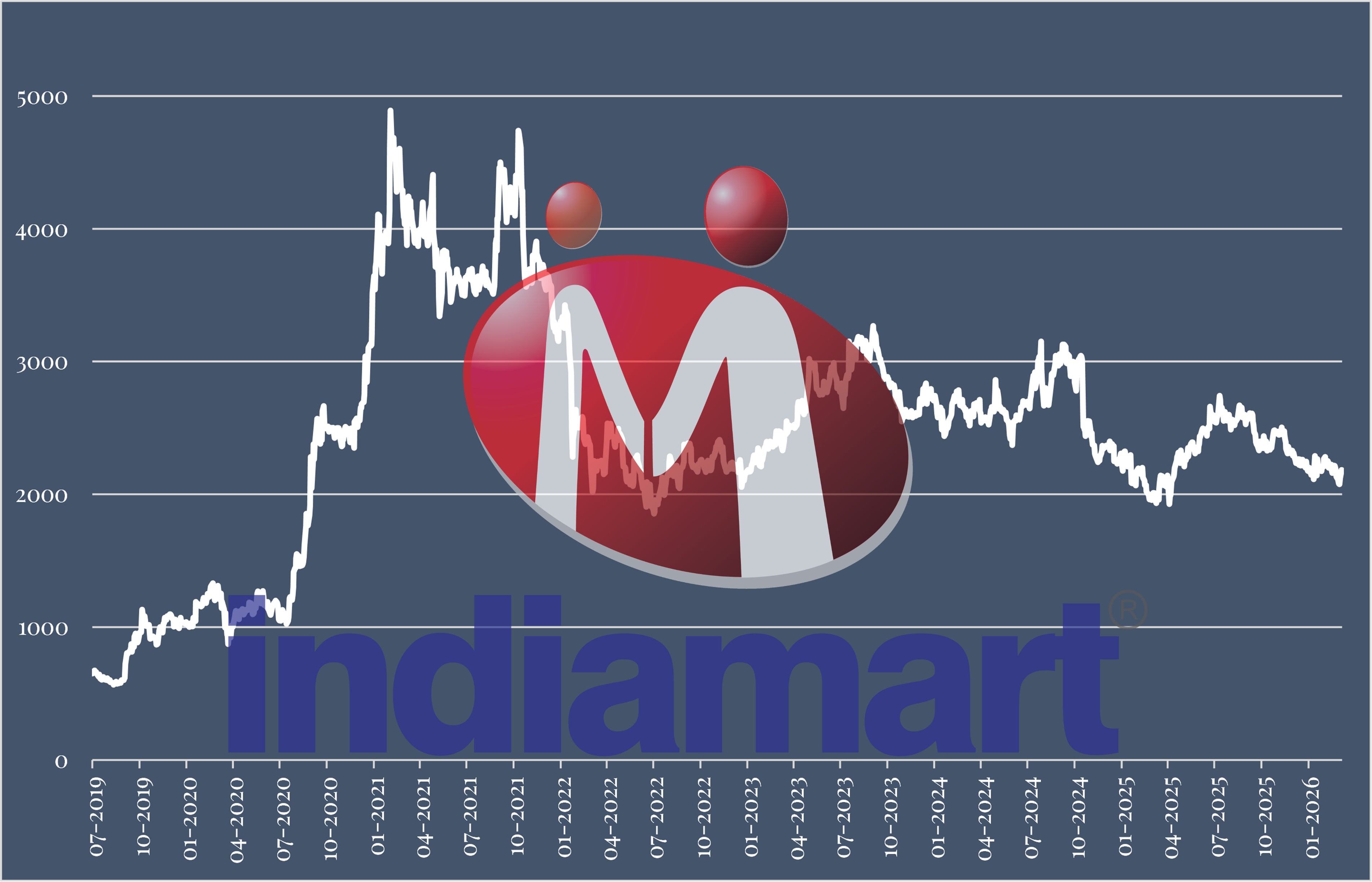

Does IndiaMART’s stock price really mirror its business reality?

The B2B marketplace has done almost everything right, attracting value investors like Pulak Prasad. Yet, the stock continues to languish.

You may also like

Business

Amitabh Chaudhry needs to rethink Axis Mutual Fund’s revival strategy

The fund house has fallen behind its peers. What explains the sub-par performance?

Business

The curious case of Rajiv Anand’s exit from Axis Bank

The announcement of the deputy managing director’s retirement in August may have more to it than meets the eye.

Business

Prashant Kumar takes spring-cleaning route to profitability

The Yes Bank CEO ushers in a spate of changes in the retail banking business to stem its loss-making streak.