Is Bandhan banking too much on microfinance?

The pandemic seems to have exposed chinks in what was seen as the best banking story this decade

17 September, 2020•16 min

0

17 September, 2020•16 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: In March 2018, some of India’s largest private sector banks were in the throes of a crisis, coming under increasing fire from the Reserve Bank of India for under-reporting their non-performing assets. The heads of two such banks were under a cloud and the private banking space, after two years of solid performance, seemed to have run into some strong headwinds. It was against this background that Kolkata-headquartered Bandhan Bank listed. It’s listing price of Rs 487 was a 30% premium to the issue price, and in the next three months, the stock rose to Rs 700, returning more than 100% to investors in the company’s initial public offer. It was then touted as a success story of founder Chandra Shekhar Ghosh, a man who had made a name for himself by lending small sums of money to credit-deprived sections of society, largely in the eastern parts of India. His business was so good that though he borrowed money from private and state-owned banks, his margins were better than all of them by a long measure. Bandhan’s net interest margin …

More in Business

Business

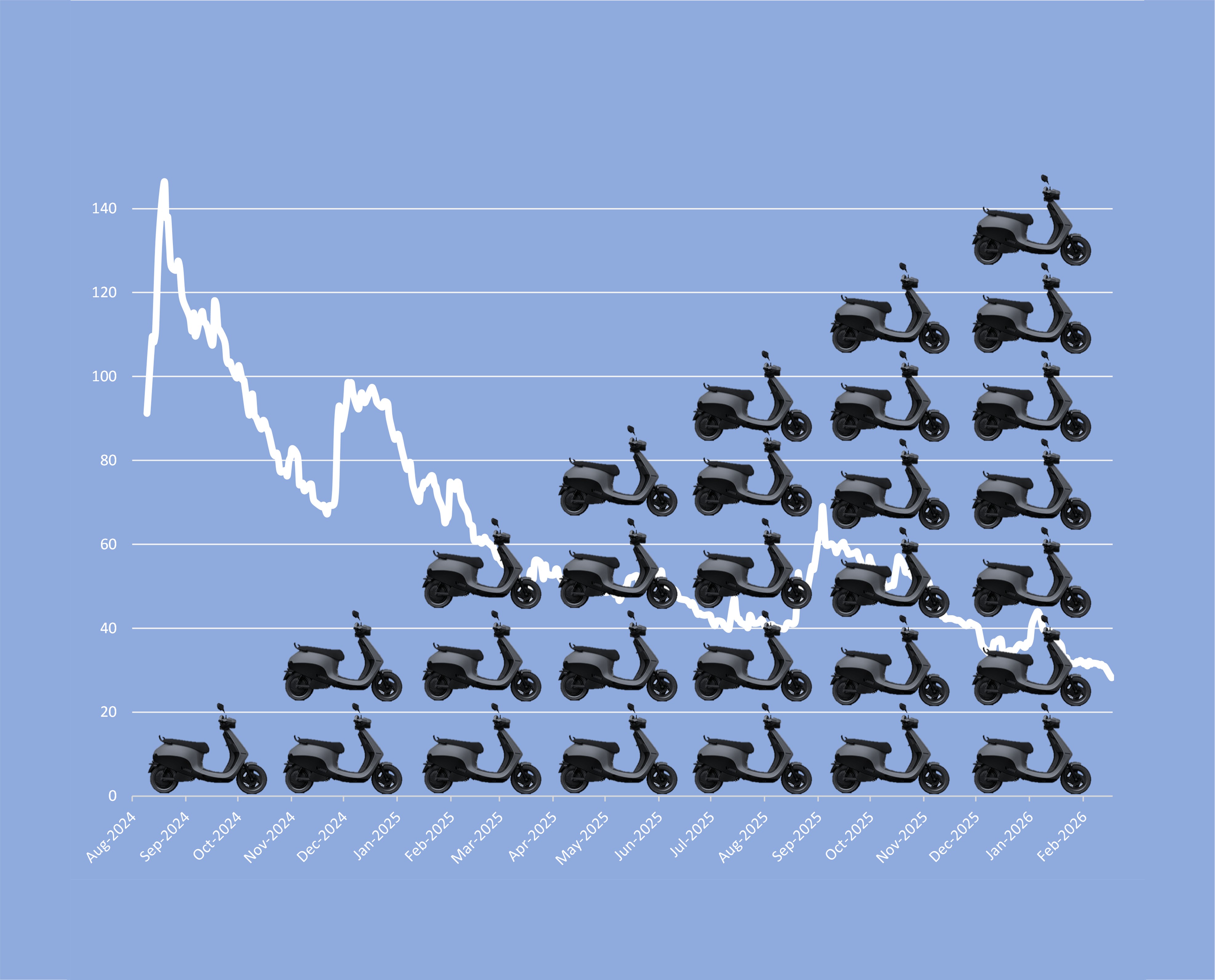

Motilal Oswal Mutual Fund’s inexplicable Ola Electric love

While its peers headed for the exit, the fund house doubled down on the falling stock. The contrarian call now looks expensive—and risky.

You may also like

Business

Banking on growth in 2026

A tumultuous year comes to a close for Indian banks, as they await a revival in borrowing in the new year.

Business

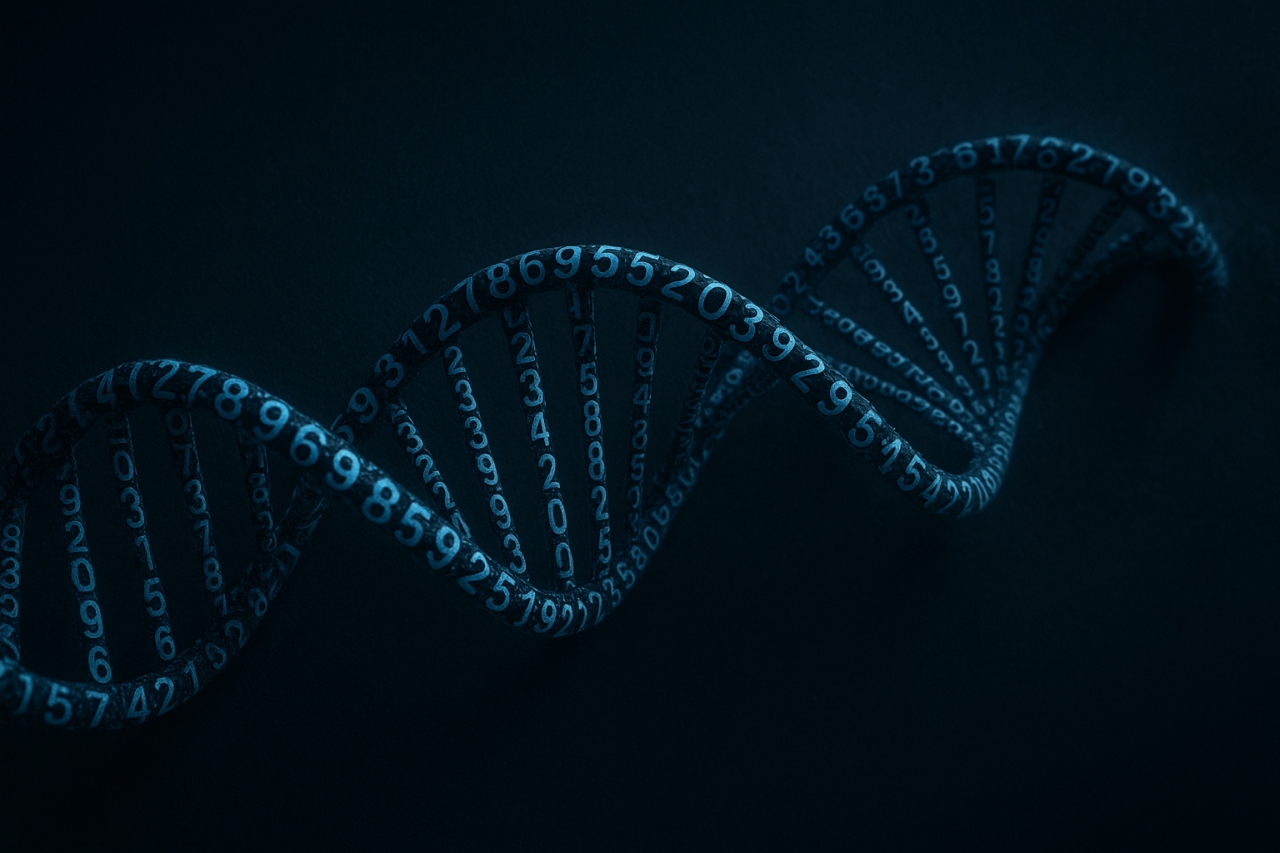

Ujjivan has to change its DNA for a universal banking licence

Cutting its decades-old reliance on microfinance loans is the only way the SFB can meet the regulator’s conditions for transitioning to a full-fledged bank

Business

From India and Pakistan, two new banks for the Emirates

The acquisition of RBL and First Women Bank, Amazon Now in the Emirates and other updates from the week.